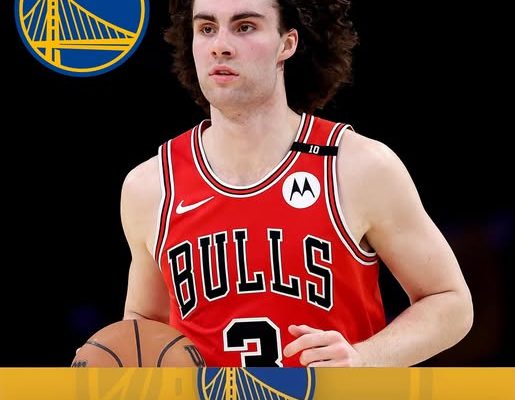

Josh Giddey’s Trade Prospects Shift as Warriors Officially Step Back from Sign‑and‑Trade Scenario

Josh Giddey’s future in the NBA has taken a dramatic turn as the Golden State Warriors, once considered a serious suitor in a potential trade, have reportedly withdrawn from pursuing the talented Australian guard. This development represents a significant shift in the ongoing offseason narrative surrounding Giddey, whose restricted free agency status has fueled speculation, negotiation maneuvering, and interest from several teams. With Golden State now stepping away from trade discussions, the landscape of Giddey’s trade options has been fundamentally altered, leaving both his current team and other interested franchises to reconsider their next moves.

Giddey, just 22 years old, has quickly become one of the league’s most versatile and exciting young guards. Following a standout post-All-Star break performance last season with averages nearing a triple-double, he solidified his value as a core piece for any team looking to build around a high-IQ playmaker. His combination of size, court vision, rebounding ability, and improved shooting made him one of the most sought-after restricted free agents of the 2025 offseason. Yet, despite his rising stock, he remains locked in a contract standoff with his current team, the Chicago Bulls, who have so far refused to meet his salary demands.

According to multiple sources close to the situation, Giddey is reportedly seeking a deal in the range of $30 million annually. In contrast, the Bulls have offered a four-year deal worth around $80 million, significantly below his expectations. The discrepancy in valuation has created a tense stalemate, with Giddey’s camp exploring every possible avenue to create leverage in negotiations. One of those strategies involved the potential for a sign-and-trade, with the Golden State Warriors frequently mentioned as a destination. The rumors gained traction due to both teams’ needs, the stylistic fit between Giddey and Golden State’s core, and the symmetry of a possible swap involving Warriors forward Jonathan Kuminga.

A Giddey-for-Kuminga framework made sense on paper. Both players were high lottery picks in the 2021 NBA Draft, with Giddey going sixth overall and Kuminga selected one pick later at seventh. The idea of exchanging two similarly aged, high-upside talents intrigued fans and analysts alike. Giddey’s skill set as a jumbo point guard who thrives in transition and in half-court facilitation seemed like an ideal complement to the Warriors’ ball-movement-heavy system. Meanwhile, Kuminga’s explosive athleticism, defensive versatility, and growth as a scorer could have filled a void for the Bulls, who are looking to infuse their roster with young talent on the wing.

Despite the intrigue, the logistical and financial realities of a sign-and-trade proved too complex. NBA rules surrounding base-year compensation for restricted free agents significantly complicate these kinds of transactions, particularly when both players are due substantial new contracts. Any sign-and-trade would have required precise salary matching, cap space navigation, and likely the inclusion of additional players or draft assets to balance the deal. Sources indicate that neither the Bulls nor the Warriors were willing to part with key rotation players or sweeteners to make the deal viable. Both sides stood firm in their valuation of their own players, and as a result, the framework collapsed before serious talks could materialize.

Compounding the issue was the Warriors’ broader salary cap situation. Golden State is already navigating the constraints of the league’s second tax apron, and adding a player like Giddey at $30 million per year would have triggered additional financial penalties and roster-building limitations under the new collective bargaining agreement. The front office, already facing difficult decisions about its core, including Stephen Curry, Klay Thompson, and Draymond Green, chose to prioritize flexibility and internal development rather than pursue an aggressive trade for Giddey. That decision effectively ended what many believed could have been one of the biggest trades of the summer.

The Warriors’ decision to step back marks a turning point in Giddey’s offseason. While it removes one of the most prominent potential trade partners from the board, it also raises questions about what comes next. With Chicago still in control of the process due to Giddey’s restricted status, any team interested in acquiring him must either convince the Bulls to engage in trade talks or present an offer sheet that the Bulls could choose to match. So far, no team has submitted a formal offer, likely due to the belief that Chicago would match any reasonable deal, thereby wasting the offering team’s time and cap flexibility.

Despite that, there are still murmurs around the league about potential interest from teams such as the Sacramento Kings, Utah Jazz, and Brooklyn Nets. Each of these franchises has been linked to Giddey in various reports, with the Kings seen as a particularly interesting fit due to their aggressive offseason strategy and desire to add more playmaking alongside De’Aaron Fox. However, none of these teams currently has a clear path to executing a sign-and-trade without major roster reshuffling, and with the Bulls’ front office holding firm, it remains to be seen whether any real traction can be gained.

In the meantime, the Bulls’ position remains unchanged. They see Giddey as a core part of their future but are unwilling to commit to a contract in the $30 million per year range without more consistency from him on both ends of the court. While his passing and rebounding are elite for his position, there are still questions about his shooting efficiency and ability to defend quicker guards. Those concerns are likely contributing factors in the Bulls’ current offer, which is designed to reflect both his potential and his limitations. However, Giddey and his camp believe that the market—and his performance—justifies a higher number.

Faced with this impasse, Giddey has a difficult decision to make. If no team is willing or able to meet his asking price in a sign-and-trade or offer sheet, he may be forced to accept the one-year qualifying offer from the Bulls. That offer, worth approximately $11.1 million, would allow him to play out the 2025–26 season and become an unrestricted free agent next summer. It’s a risky path, as it offers no long-term security and carries the potential downside of injury or a down season. However, it also gives Giddey full control over his next destination in 2026 and could ultimately lead to a larger payday if he continues his upward trajectory.

From a strategic standpoint, accepting the qualifying offer would be a bold move that few restricted free agents take. It’s a bet on oneself, the type of decision that only confident players with strong belief in their long-term value are willing to make. Giddey’s post-All-Star numbers and rising profile suggest he may be that kind of player. But it’s not a decision that will come lightly, especially with millions of guaranteed dollars potentially on the table if a long-term agreement can be reached.

For now, Giddey’s camp continues to explore all options, and league insiders expect the stalemate to stretch deeper into the offseason unless one side budges. The Bulls are under no immediate pressure to increase their offer, especially given the lack of outside movement. Giddey, meanwhile, must weigh the value of stability versus the opportunity to hit the open market next year with full autonomy. The hope within his camp is that more teams will enter the picture as training camp approaches and that Chicago may be more open to revisiting talks if the threat of losing him next summer becomes more real.

Ultimately, the Warriors’ decision to walk away from the negotiating table has shifted the dynamics of the offseason for both Giddey and the Bulls. What once looked like a potentially explosive trade scenario has cooled, replaced by a more uncertain and drawn-out negotiation process. While other teams may still enter the fray, the path to a resolution is now far murkier than it appeared just weeks ago. With preseason on the horizon and contract talks seemingly stalled, the question now isn’t just where Josh Giddey will play next season—it’s what he’s willing to do to take control of his career, and whether the Bulls are prepared to meet him halfway.

The coming weeks will be crucial. Whether it ends with a long-term extension, a bold one-year gamble, or a late-offseason trade, the Josh Giddey saga is far from over. But one thing is now clear: with the Warriors out of the picture, the next chapter of his young career will be written elsewhere. And in a league driven by power, potential, and patience, the next move could define both his future and that of the franchise that holds his rights.